Circle Research and Inco Explore Framework For Encryption-Powered Confidential ERC20 Tokens

.jpg)

Blockchains are the future of financial infrastructure, presenting a means for people and institutions to transact without intermediaries. However, in their current form blockchains fall short on confidentiality: with their public, pseudonymous design, they lack the robust confidentiality needed for widespread consumer and enterprise adoption.

Users often use infrastructure such as centralized exchanges to achieve confidentiality, reintroducing the points of failure and mediated architecture that blockchains exist to avoid. On the other hand, solutions such as private chains do not offer the liquidity and developer activity of existing public blockchains like Ethereum, while privacy solutions focused on anonymity like mixers are not compatible with the compliance and regulatory requirements that consumers and individuals need.

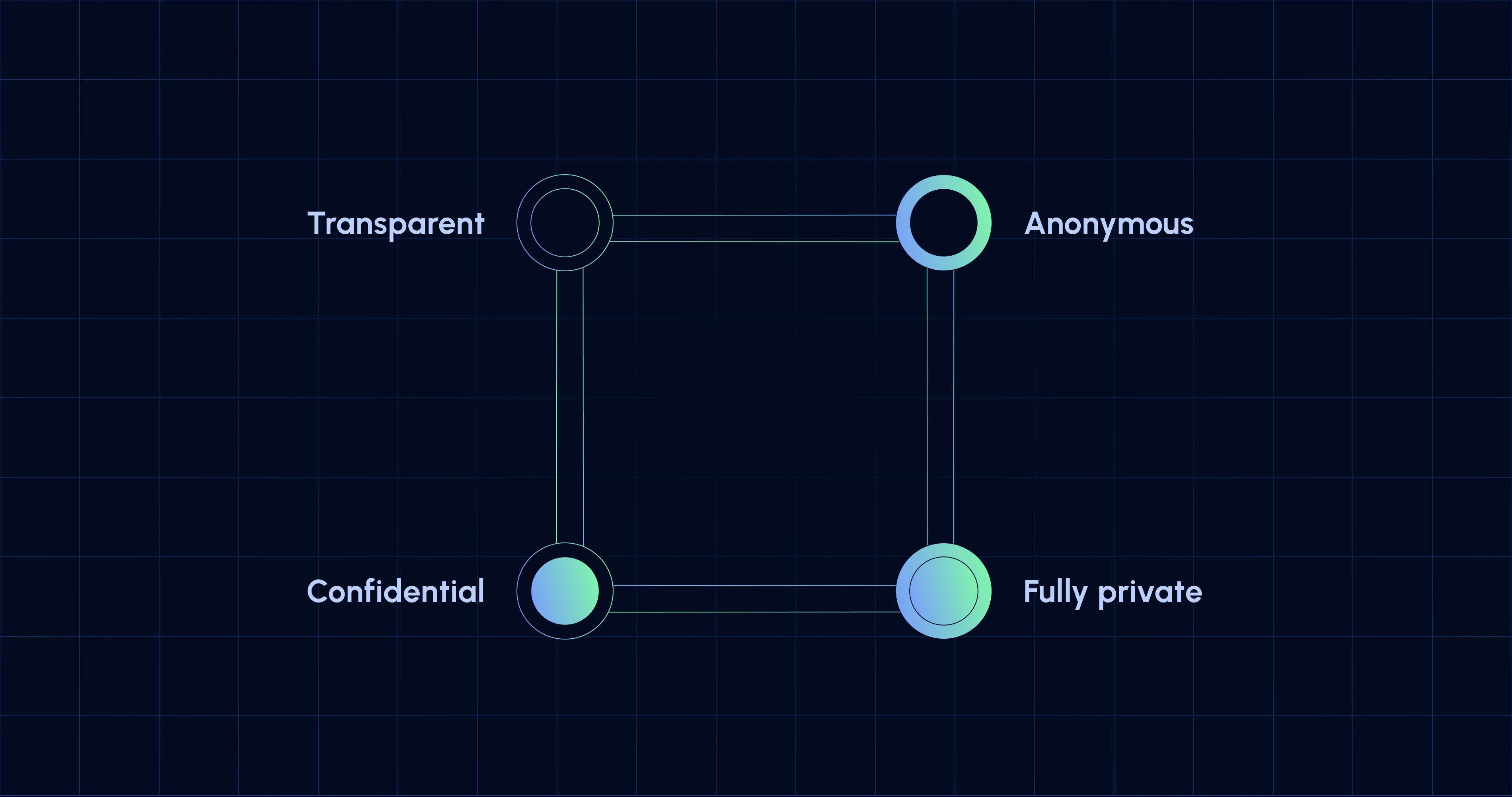

Circle Research and Inco have collaborated to introduce a framework for confidential ERC20 tokens powered by Fully Homomorphic Encryption (FHE), which enables computation upon encrypted data without the need to decrypt it. Users wrap their ERC20 tokens to transform them into confidential ERC20 equivalents (this framework could also support a mint and burn mechanism). Confidential ERC20 tokens can hide the amount transferred between addresses using FHE, while keeping the flow of funds visible.

You can read the full report here. Thank you to our research partners Kaili Wang and Jacob Hirshman, and to Dan Boneh and Michael Mosier for their advisory input.

Looking to learn more about how FHE can support your payments use case? Get in touch with us here.

READ THE REPORT

This framework offers key advantages over other confidentiality methods, such as maintaining the liquidity and composability of the Ethereum ecosystem, compatibility with the popular ERC20 framework, and the means to give third parties the ability to verify specific aspects of transaction data.

The process is simple: users wrap their existing ERC20 tokens to receive confidential ERC20 (cERC20) tokens. Transfer amounts and address balances are encrypted through an FHE-augmented version of the Ethereum Virtual Machine (EVM) at the precompile or coprocessor level, enabling confidential tokens (e.g. confidential USDC/cUSDC) to exist across EVM-compatible ecosystems, maintaining composability and liquidity. Transfer rules or blacklist requirements to meet standards such as anti-money laundering (AML) requirements can be adhered to without decrypting the data. Finally, users can swap their cERC20 tokens back to standard ERC20 tokens when they want to.

Confidentiality unlocks a host of use cases, particularly across payments and DeFi:

Payments-Related Use Cases:

- Private cross-border payments: Enable private international transactions, protecting sensitive financial details while complying with local regulations.

- Private token vesting: Manage and automate the distribution of vested tokens, ensuring confidentiality of allocation schedules and amounts.

- Private B2B payroll: Facilitate private payroll between businesses, safeguarding salary details and ensuring compliance with regulatory requirements.

- International remittances: Provide a secure and private channel for transferring funds across borders, protecting senders and recipients from exposure and fraud.

DeFi-Related Use Cases:

- Private AMM & darkpools: Execute private token swaps, where transaction amounts are encrypted, preventing frontrunning and protecting trading strategies. The implementation presents interesting challenges that can be further explored in future research.

- Private RWA tokenization: Tokenize real-world assets with privacy-preserving features, safeguarding sensitive ownership and transaction details.

- Blind auction: Facilitate auctions where the bid remains confidential until the auction concludes, ensuring a fair and competitive bidding process.

- Private lending: Enable private loans with confidential terms and collateral, preserving borrower privacy. Potentially support undercollateralized lending by incorporating onchain credit scores to assess creditworthiness privately.

If you’re interested in learning more about the confidential ERC20 framework, read the full report.

Looking to learn more about how FHE can power your use case? Get in touch with us here.

Incoming newsletter

Stay up to date with the latest on FHE and onchain confidentiality.

.svg)